26+ Indiana payroll calculator

Get Started With ADP Payroll. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

1

Free Unbiased Reviews Top Picks.

. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Indiana has a flat income tax price meaning youвЂre taxed during the exact exact same 323 price irrespective of your revenue degree or filing status.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The aggregate of Indian state income tax and local tax applicable in a. Ad Compare This Years Top 5 Free Payroll Software.

26 Indiana payroll calculator Jumat 02 September 2022 Edit. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. This tool has been available since 2006 and is visited by over 12000. SUTA runs from 05 and 74.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Calculating your Indiana state income tax is similar to the steps we listed on our Federal. No personal information is collected.

Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Choose Your Paycheck Tools from the Premier Resource for Businesses. Indiana Salary Paycheck Calculator.

A financial advisor in In can help. Discover ADP Payroll Benefits Insurance Time Talent HR More. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Indiana Taxes range from 323 and county taxes range from 05 to 2864. There are reciprocal agreements for the five states you need to know. Ad Compare This Years Top 5 Free Payroll Software.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Ad Get the Paycheck Tools your competitors are already using - Start Now. 26 Indiana payroll calculator Jumat 02 September 2022 Edit.

It is not a substitute for the advice of. 185 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. This free easy to use payroll calculator will calculate your take home pay.

As an employer you must match this tax dollar-for. Our paycheck calculator is a free on-line service and is available to everyone. Free Unbiased Reviews Top Picks.

If you are a web payroll customer you must enter payroll data directly into your Payroll USA assigned Payroll account if you would like it processed for an upcoming payroll period. Get Started With ADP Payroll. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only.

Indiana Hourly Paycheck Calculator. 12 per year while some are paid twice a month on set dates 24 paychecks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Bradford Place Apartments 3224 S 9th St Lafayette In Rentcafe

Inaccuracies With And S Salary Calculator R Dietetics

Sales Tax Calculator

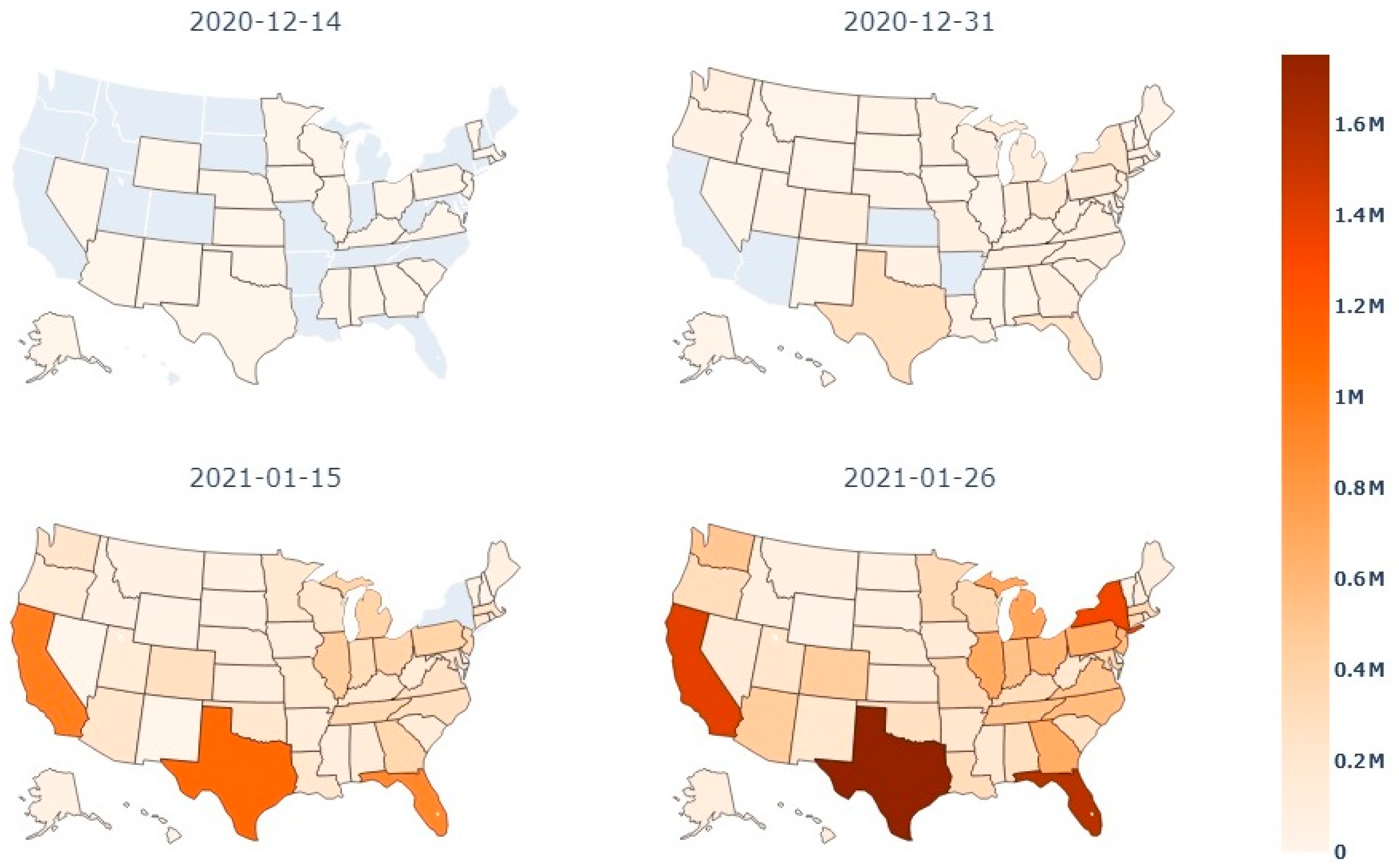

Ijerph Free Full Text Phased Implementation Of Covid 19 Vaccination Rapid Assessment Of Policy Adoption Reach And Effectiveness To Protect The Most Vulnerable In The Us Html

Sales Tax Calculator

Free 8 Sample Employee Tax Forms In Pdf Ms Word

Netfor Netfor Twitter

Tuesday Tip How To Calculate Your Debt To Income Ratio

Free 13 Sample Employment Contract Forms In Pdf Ms Word Excel

Revenue Share Canzell Careers

1

California Minimum Wage 2022 Minimum Wage Org

1

Speeding Ticket Cost Calculator In The Us How Much To Pay

Free 8 Sample Employee Tax Forms In Pdf Ms Word

How Much Is A Speeding Ticket In California Other States

1